Hello Investors,

Thank you for visiting the PrimeETF blog!

We’ve been diligently enhancing our platform with new tools and charts to provide clutter-free investing insights. Feel free to log in and explore the updates! – Click here

Simplifying Investing with PrimeETF:

PrimeETF aims to simplify investing and eliminate analysis paralysis, requiring less than ten minutes a month to manage. Let’s dive into the portfolio performance and changes for September 2024.

August 2024 Market Overview:

Source: SPDR Sectors

In August 2024, the Energy sector suffered the most, losing 1%, while real estate, utilities, and consumer staples gained over 5%.

As investors, our focus shouldn’t be on explaining negative sentiment but on identifying smart money movements and investing wisely to protect our portfolio from severe drawdowns, aligning with the most robust sectors.

September 2024 Outlook:

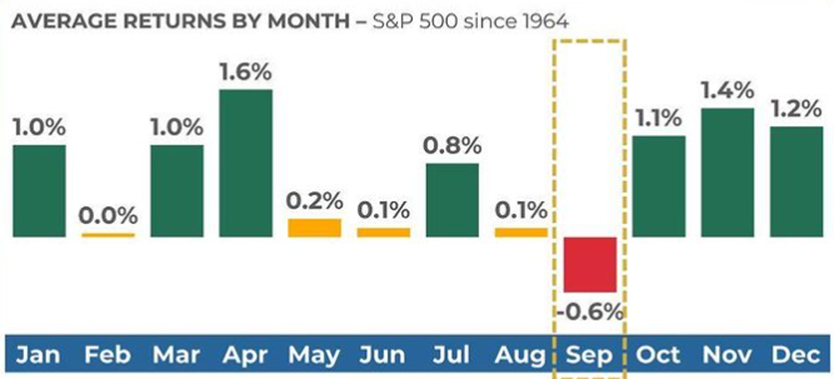

Historically, September has been the worst month for the S&P 500 regarding average returns. As you can see from the image below, Over the past 60 years, September has been down on average by 0.6%

Source: Weekly Stocks

PrimeETF Portfolio:

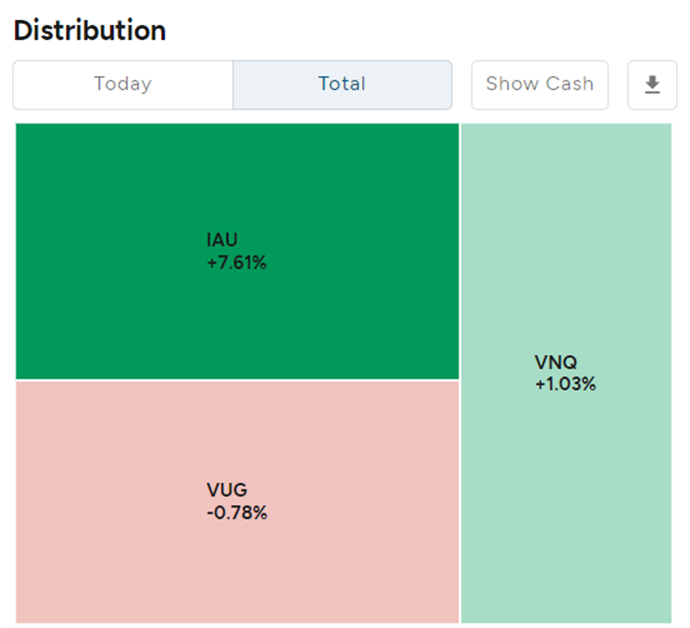

The PrimeETF portfolio had the following ETFs in August 2024:

1. VUG – Vanguard Growth ETF

2. IAU – iShares Gold Trust

3. VIOG – Vanguard Small cap 600 Growth ETF

Returns as of August 30, 2024:

1. VUG: -0.78%

2. VIOG: -2.42%

3. IAU: +7.61%

Portfolio Changes for September 2024:

On August 30, 2024, we adjusted to eliminate the losers and buy the winners. Below are the changes:

Portfolio Rebalance for September 2024 (Equal Allocation):

1. VUG – Vanguard Growth ETF

2. IAU – iShares Gold Trust

3. VNQ – Vanguard Real Estate Index ETF

We sold off VIOG, booked a loss of 2.42%, and bought VNQ.

Source: PrimeETF Portfolio Changes

Source: PrimeETF September 2024 Portfolio

Performance Expectations:

PrimeETF is designed to underperform the S&P 500 during bull markets and outperform it during bear markets. PrimeETF aims to match the S&P 500’s performance across an entire market cycle, outperforming the traditional 60/40 and lazy portfolios.

Holdings for September 2024:

Source: PrimeETF September 2024 Portfolio

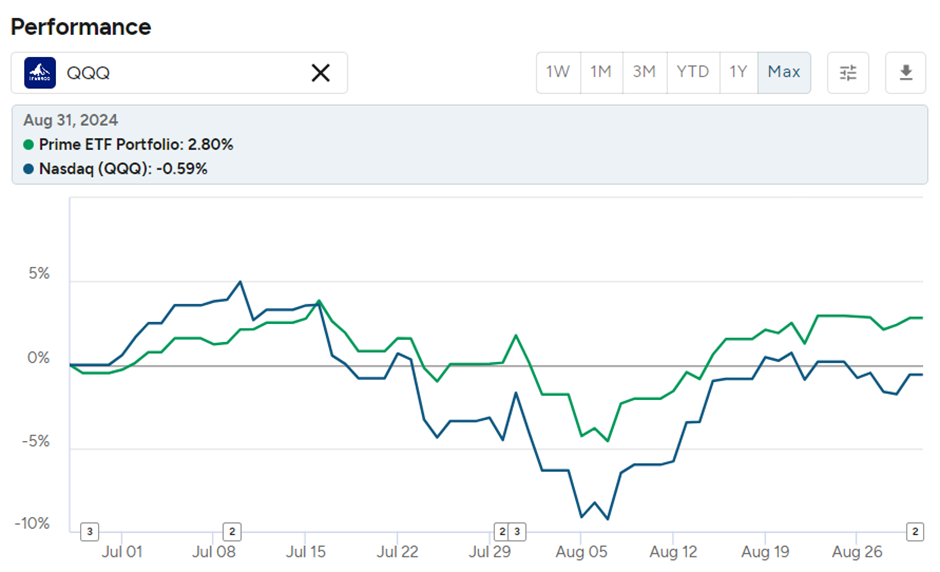

PrimeETF Performance:

PrimeETF: 2.80%

S&P 500: 3.58%

NASDAQ 100: -0.59%

As markets turn bearish, PrimeETF experiences a lower drawdown than the S&P 500 and NASDAQ 100, mainly due to holdings in gold (IAU) and Real Estate ETF (VNQ).

Performance Comparison with S&P 500:

Performance Comparison with Nasdaq 100:

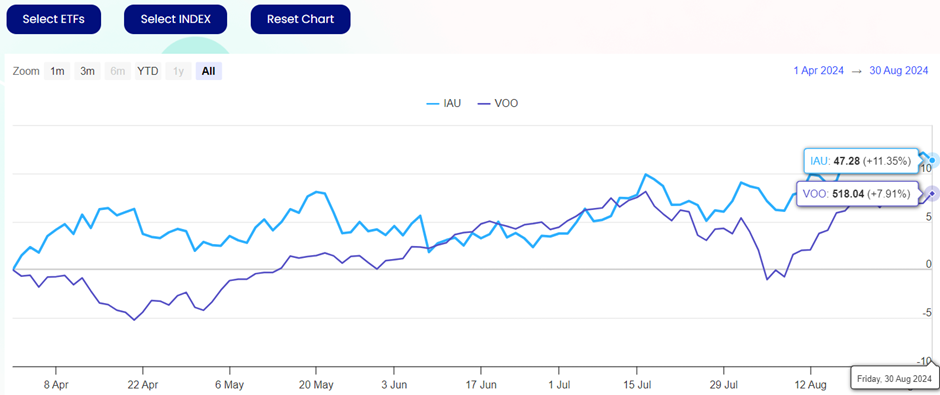

Charts from PrimeETF:

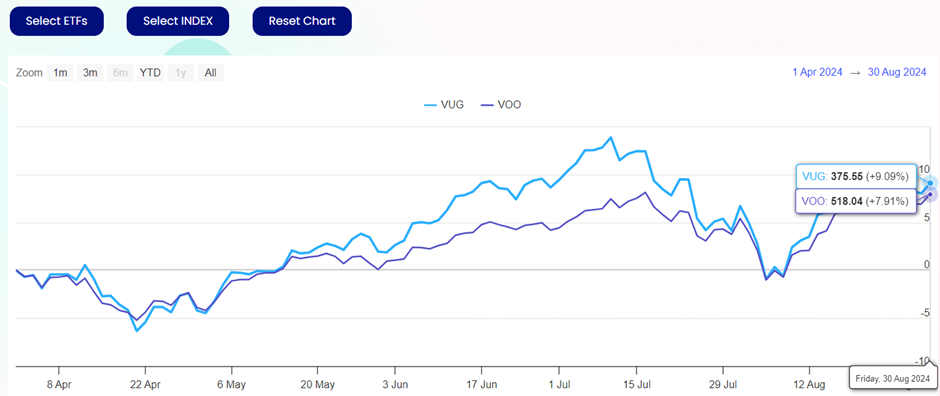

Real Estate ETF (VNQ) outperforming the S&P 500 (VOO):

Source: PrimeETF Charts

Vanguard Growth ETF (VUG) outperforming the S&P 500 (VOO):

Source: PrimeETF Charts

Gold (IAU) Outperforming the S&P 500 (VOO):

Source: PrimeETF Charts

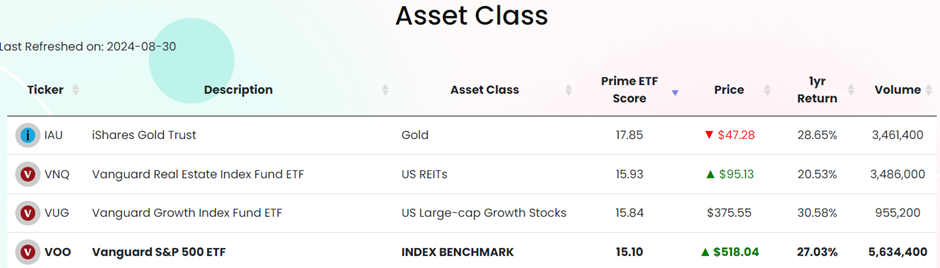

Asset Class Performance Table:

https://primeetf.com/asset-class/

Don’t miss out on more updates and insights. Join PrimeETF here

Important Disclaimer:

This is not a stock/ETF buy/sell recommendation. You can invest at your own risk. Following this portfolio may lead to a total capital loss. Always consult a certified financial advisor before making investment decisions.

Conclusion:

In investing, the real value lies not in complex patterns but in the stories and trends behind stocks and ETFs. Avoid overanalyzing and focus on the narratives and trends where real opportunities exist.

These views are my own and do not represent my firms’. I welcome your feedback and corrections.

I look forward to sharing this journey with you!

Stay tuned for more updates, and let’s embark on this journey of prudent investing together!

Leave a Reply

You must be logged in to post a comment.