Hello PrimeETF Community,

We have wrapped up another successful month, and I’m happy to share the rebalance updates along with a quick comparison of how the PrimeETF portfolio performed against the S&P 500 (SPY) and Nasdaq 100 (QQQ). Let’s dive into the key changes and performance metrics.

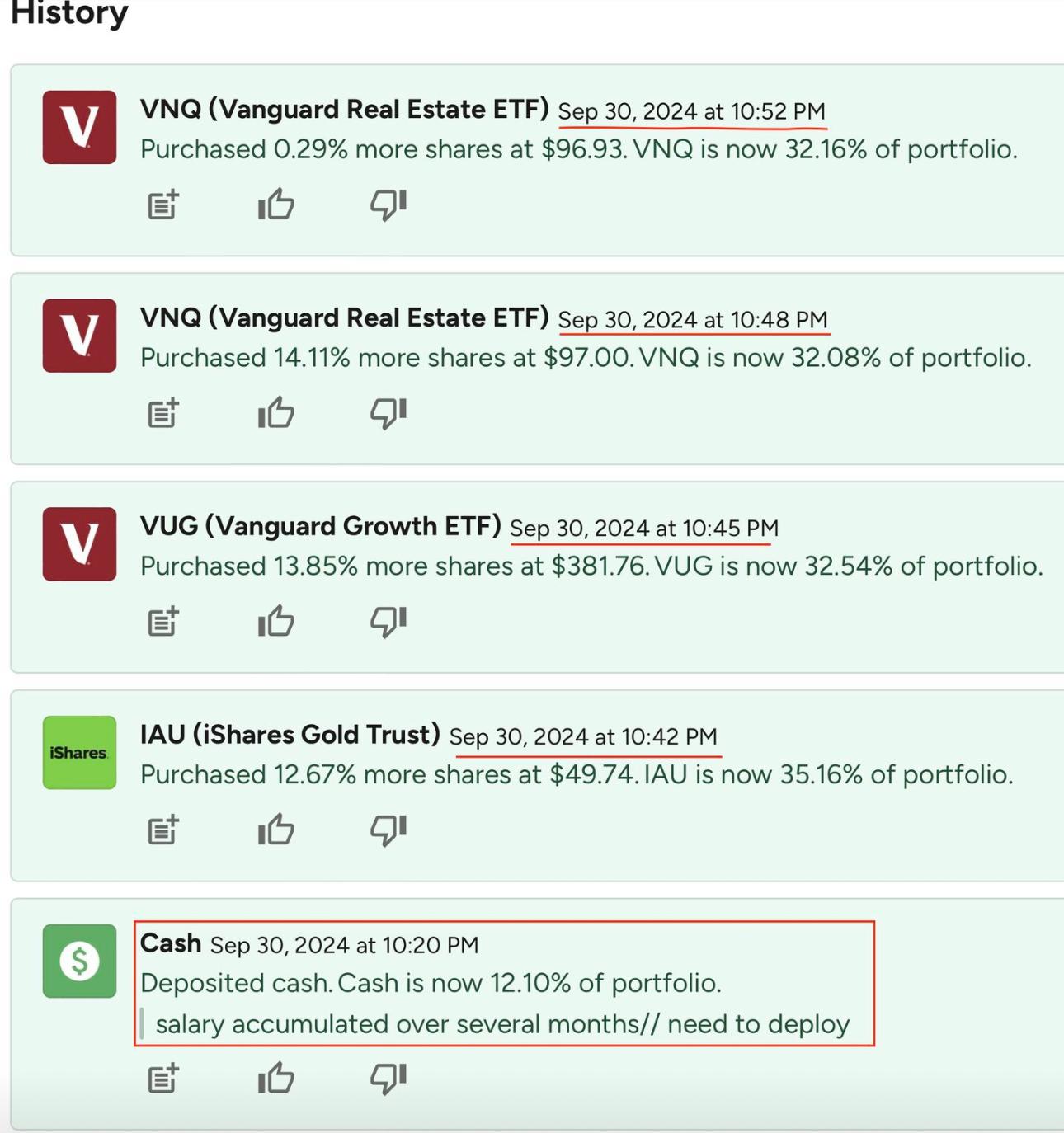

Rebalance Details – End of September 2024:

1. Vanguard Real Estate ETF (VNQ):

– Purchased an additional 14.11% shares at $97.00 and 0.29% more at $96.93

– VNQ now makes up 32.16% of the portfolio.

2. Vanguard Growth ETF (VUG):

– Added 13.85% more shares at $381.76.

– VUG represents 32.54% of the portfolio.

3. iShares Gold Trust (IAU):

– Purchased 12.67% more shares at $49.74.

– IAU now makes up the largest part of the portfolio at 35.16%.

4. Cash Deposits:

– Deposited new cash, now 12.10% of the portfolio.

Source: PrimeETF September 2024 Portfolio

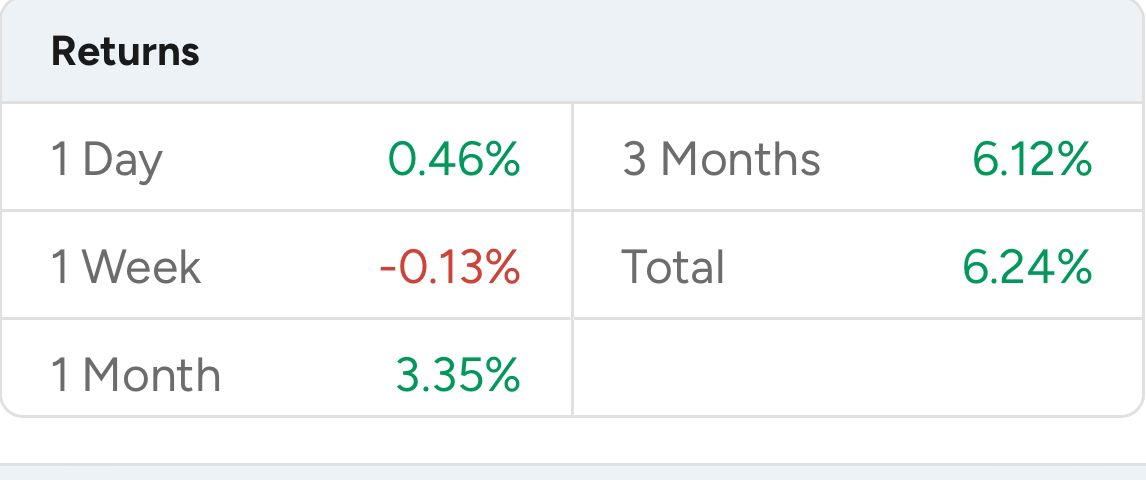

Portfolio Performance Overview:

- 1 Month: +3.35%

- 3 Months: +6.12%

- Total Return: +6.24%

Source: PrimeETF September 2024 Portfolio

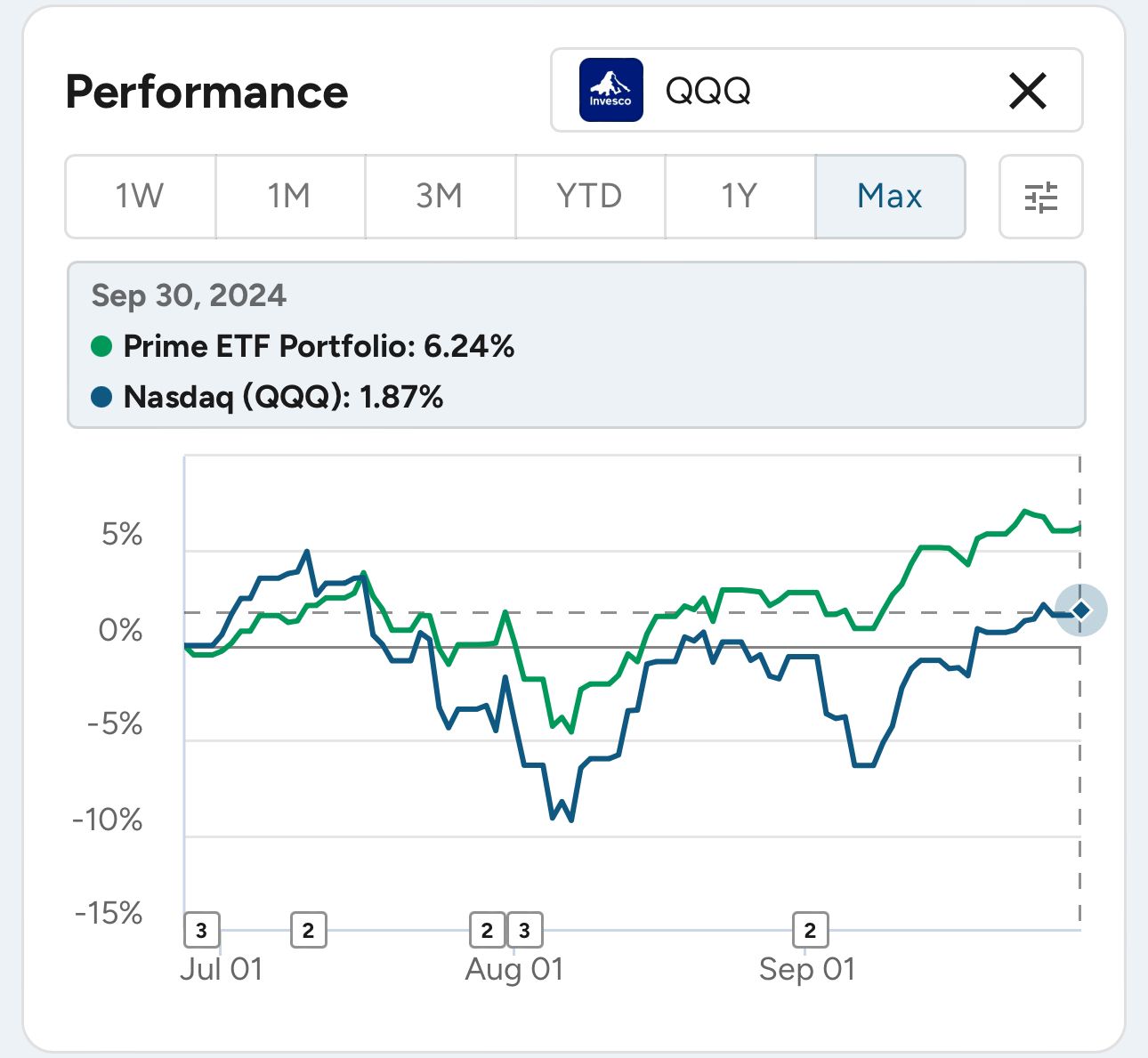

Comparison with Major Indexes:

S&P 500 (SPY) vs. PrimeETF

– The PrimeETF portfolio has returned 6.24%, outperforming the S&P 500’s 5.43% during the same period.

– This shows that our strategy is working, staying ahead of one of the most popular benchmarks.

Source: PrimeETF September 2024 Portfolio

Nasdaq 100 (QQQ) vs. PrimeETF:

– PrimeETF’s return of 6.24% outperformed QQQ’s 1.87%, showing the portfolio’s resilience in growth and risk management compared to tech-heavy investments.

Source: PrimeETF September 2024 Portfolio

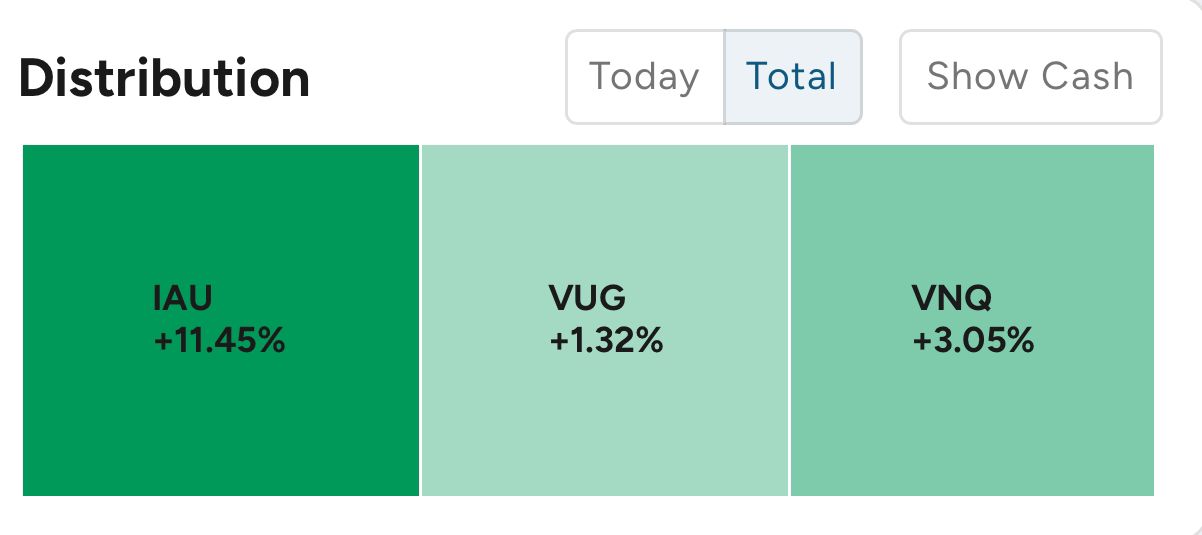

Distribution Breakdown:

– IAU (iShares Gold Trust) has contributed the most to performance with a +11.45% gain.

– VNQ (Vanguard Real Estate ETF) delivered a +3.05% gain.

– VUG (Vanguard Growth ETF) has added +1.32% to the portfolio.

Source: PrimeETF September 2024 Portfolio

Final Thoughts:

We’ve seen strong performance in gold (IAU) and real estate (VNQ), while the growth sector (VUG) continues to build up as a solid part of the portfolio.

Looking forward, we will continue to strategically deploy cash into new opportunities as they arise, keeping a balanced approach for strong growth while managing risks.

Keep watching for more updates!

Best,

The PrimeETF Team

Leave a Reply

You must be logged in to post a comment.