Hope in Chaos—gold in Portfolios.

PrimeETF Update – April 2025 Edition (Data till May 9).

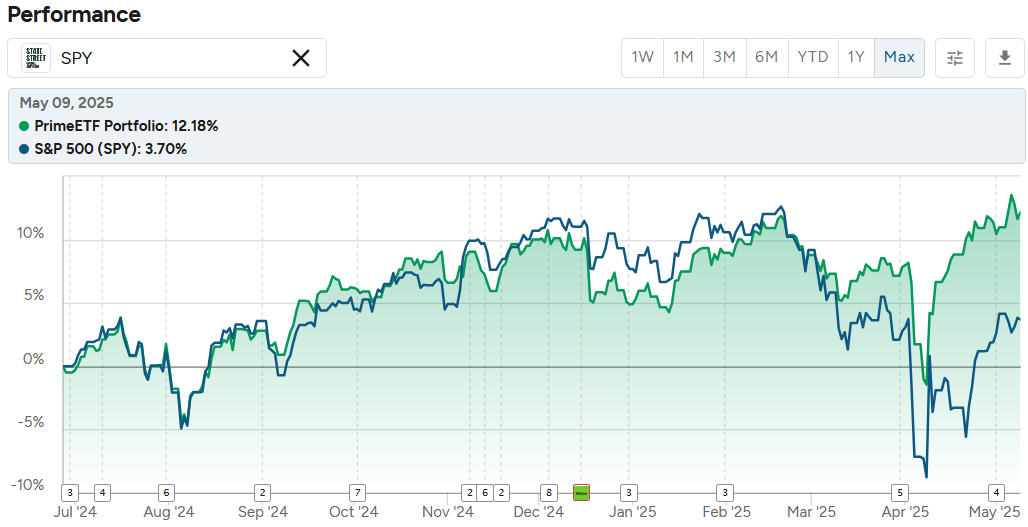

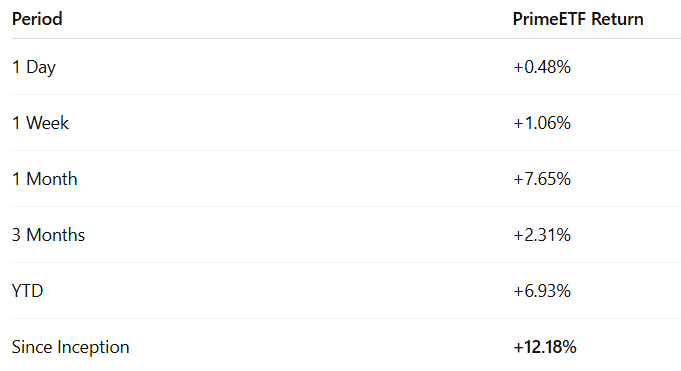

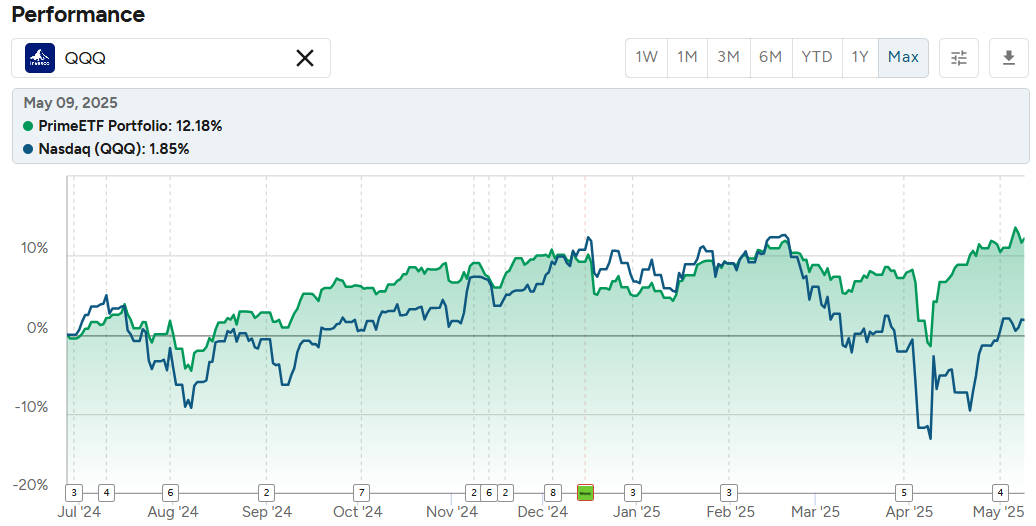

As the world’s attention shifts from tariff skirmishes to a more serious India–Pakistan conflict, markets are reacting fast and emotionally. But amidst the chaos, the PrimeETF Portfolio stood firm with a 12.18% total return since launch (June 28, 2024), comfortably ahead of Nasdaq 100 (1.85%) and S&P 500 (3.70%).

Portfolio Performance

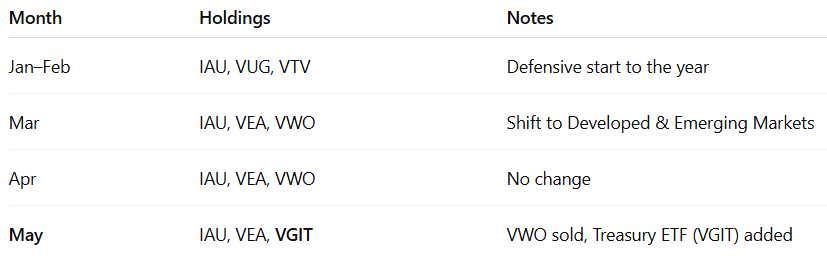

April–May Portfolio Rebalance:

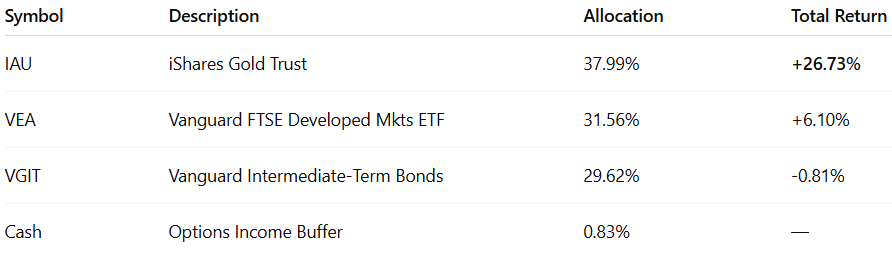

Current Allocation (as of May 9):

Global Outlook

- The India–Pakistan conflict has rattled investors globally. While the humanitarian impact is heartbreaking, investors are also bracing for a fallout in trade and energy prices.

- Gold is shining as a safe haven — our largest holding, IAU, is leading the portfolio’s gain.

- Bond exposure (VGIT) adds stability amidst volatility, even if near-term returns are muted.

- Tech-heavy indices are recovering slowly from April’s sharp dip, but lag behind diversified strategies like PrimeETF.

Sea Cargo & War Impact:

The maritime industry is feeling the heat:

- Rerouting ships to avoid conflict zones is increasing voyage time and fuel costs.

- Insurance premiums for cargo moving through affected regions are spiking.

- Commodities like oil, grains, and fertilisers face global delays, adding inflation pressure.

Who pays? Eventually, consumers and businesses will face higher shipping costs and price tags on essential goods.

Here are five key reasons why the PrimeETF portfolio outperformed the Nasdaq (QQQ) and S&P 500 (SPY) as of May 9, 2025:

1.Gold Allocation (IAU) as a Defensive Core

While equities tumbled due to geopolitical tension, gold surged.

PrimeETF maintained a large position in iShares Gold Trust (IAU), which delivered a +26.73% return, acting as a strong hedge.

This non-correlated asset helped cushion volatility and lifted overall returns.

2.Tactical Exit Before Major Market Drop

VUG (Growth) and VTV (Value) positions were exited in late March before the sharp April crash.

Avoiding the drawdown preserved capital while indexes fell 7–11%.

3.Timely Rotation into Bonds (VGIT)

PrimeETF was allocated to VGIT (Intermediate Treasury Bonds) in April, a low-risk asset offering stability and interest income.

Though slightly negative in return, VGIT helped reduce portfolio volatility during uncertainty.

4.Global Diversification via VEA

Exposure to Vanguard FTSE Developed Markets ETF (VEA) provided a broader international cushion.

VEA posted +6.10%, benefiting from stronger global equity performance outside the U.S.

5.Options Income Supplement

Additional cash from covered call options was reinvested smartly, adding cash flow without increasing risk.

This passive income stream helped boost the overall return while others stayed sidelined.

In short: Avoiding tech-heavy risk, holding gold, diversifying globally, rotating into bonds, and earning options income — that’s how PrimeETF achieved a 12.18% return while Nasdaq barely moved and S&P struggled.

More From PrimeETF

Final Thoughts:

While emotions ran high in April, PrimeETF stuck to its algorithm, protected capital, and stayed diversified. We pray for peace and stability, and continue to build portfolios that can weather wars and rallies.

Disclaimer:

This is not financial advice. Please consult your financial advisor before making investment decisions. All opinions expressed are personal and not for any organisation. Investing in PrimeETF is at your own risk.

Leave a Reply

You must be logged in to post a comment.