PrimeETF October 2025 Newsletter

The markets rarely sleep. Neither do uncertainties. But a system-driven investor does not need to predict or panic. They just need to prepare.

Welcome to the October edition of the PrimeETF newsletter.

This month, we:

- Review macro trends and market signals

- Show how PrimeETF continues to outperform static benchmarks

- Launch of Crypto ETFs dashboard and inclusion in our portfolios

Let’s dive in.

Global Macro & Market Overview

U.S. Dollar Weakness:

- The U.S. Dollar Index (DXY) fell ~0.70% over the last month and ~4.68% YoY as of Oct 1, 2025

- The U.S. dollar is weakening due to a combination of economic policies, labor market data, and rising national debt, leading to decreased investor confidence and expectations of Federal Reserve rate cuts.

Emerging Markets:

- Benefiting from a weaker dollar and regional rate cuts

- Flows returning to local currency bonds and equities

Developed Markets:

- U.S. large-cap tech and semiconductors lead gains

- European stocks recover on disinflation trends

Commodities & Crypto:

- Gold (IAU): Rising due to USD weakness and global uncertainty

- Crypto (via GDLC): Rebounding after Ethereum ETF approvals and institutional flows in IBIT.

What This Means:

- Static portfolios will underperform, and 60/40 portfolios are dead.

- Timing and factor rotation matter more than ever.

- Diversification needs to be dynamic, not just broad.

PrimeETF Portfolio Performance

Since Inception (June 28, 2024 – October 3, 2025):

Visuals That Tell the Story

1. PrimeETF vs Benchmarks

- PrimeETF: +30.73% Total Return

- QQQ: +25.90%

- SPY: +22.97%

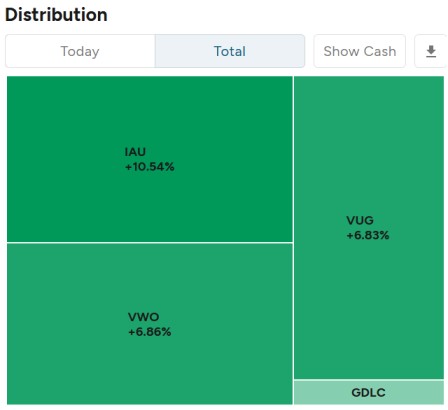

2. Portfolio Composition Tree Map

- IAU: +10.54% (gain since 1st Sep 2025)

- VWO: +6.86% (gain since 1st Sep 2025)

- VUG: +6.83% (gain since 1st Sep 2025)

- GDLC: +2.53% – new addition

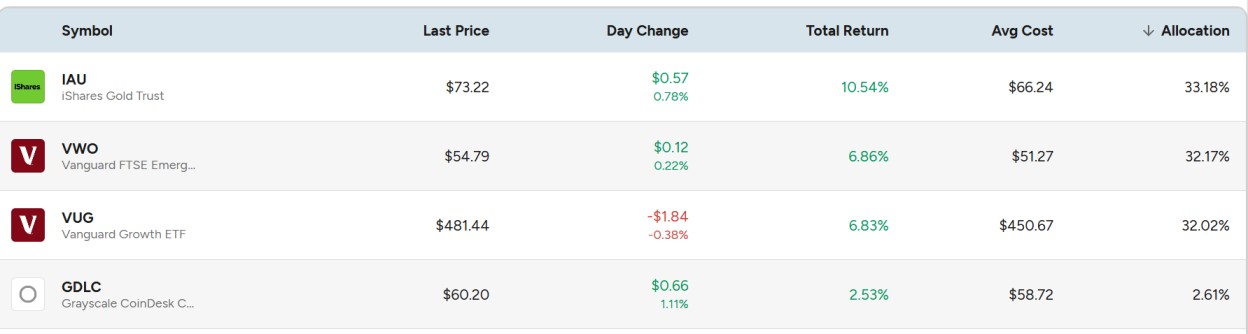

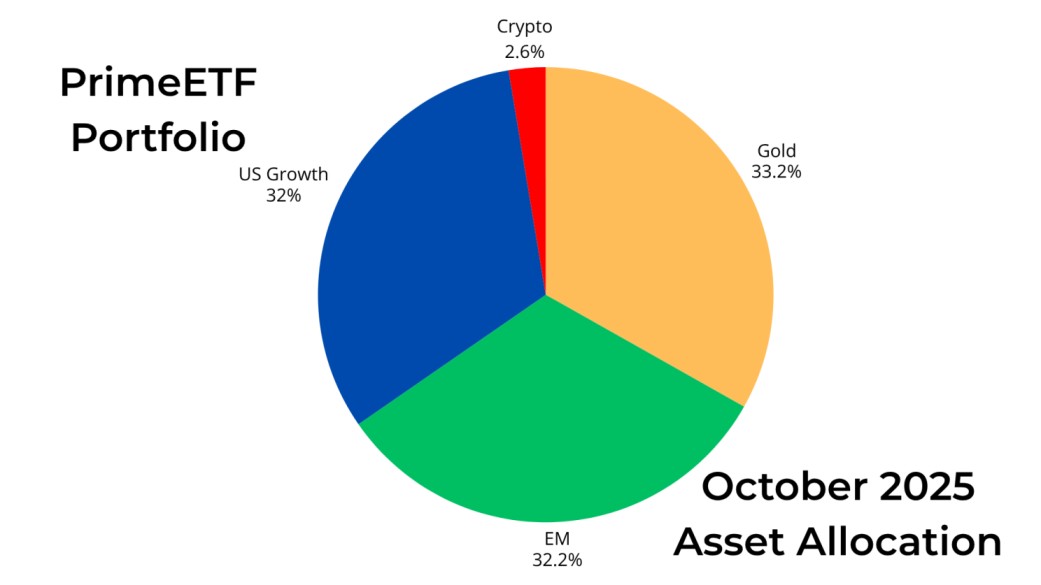

Asset Allocation (as of October 3, 2025)

Why we replaced IBIT with GDLC?

We replaced IBIT (Bitcoin-only ETF) with GDLC (Grayscale CoinDesk Crypto 5 ETF) to gain broader exposure to digital assets.

GDLC tracks the top 5 crypto assets by market cap, offering diversified exposure beyond Bitcoin, including Ethereum and other large cap cryptos.

Grayscale CoinDesk Crypto 5 ETF (GDLC) is an index-style crypto ETF that gives exposure to the top 5 crypto assets based on market cap and liquidity. It includes Bitcoin, Ethereum, Solana, XRP, and Cardano — removing the need to pick a single token. GDLC is ideal for diversified crypto exposure with lower concentration risk.

As of this update, GDLC holds approximately:

- 73.4% Bitcoin

- 16.42% Ethereum

- 5.4% XRP

- 3.78% SOL

- 0.95% Cardano

GDLC ETF has an expense ratio of just 0.59%.

We have capped crypto allocation to max 5% of the portfolio to manage volatility.

AI: A Shift in Market Drivers

Artificial Intelligence remains the defining trend of this market cycle. However, performance dispersion is growing:

- U.S. large-cap tech shows strength but also signals of exhaustion.

- Emerging Markets like India, Taiwan, and Brazil benefit from AI infrastructure demands (semiconductors, rare earths).

- Gold and crypto are rising as investors seek alternatives amidst rising macro volatility.

AI is not just fueling growth stocks — it’s reshaping global supply chains and capital flows.

Why PrimeETF Outperformed

The secret? It’s not a secret at all:

- Data-Driven ETF Selection Rule-based systematic investing where ETFs are ranked by algorithm, not media hype.

- No Overlap, Maximum Exposure Themes, sectors, and geographies are screened for distinctiveness.

- Monthly Rebalancing Winners stay. Laggards are rotated out.

- Skin in the Game This is a real-money portfolio — no paper trades.

- Simplicity Over Noise No predictions. No over-optimization. Just monthly discipline.

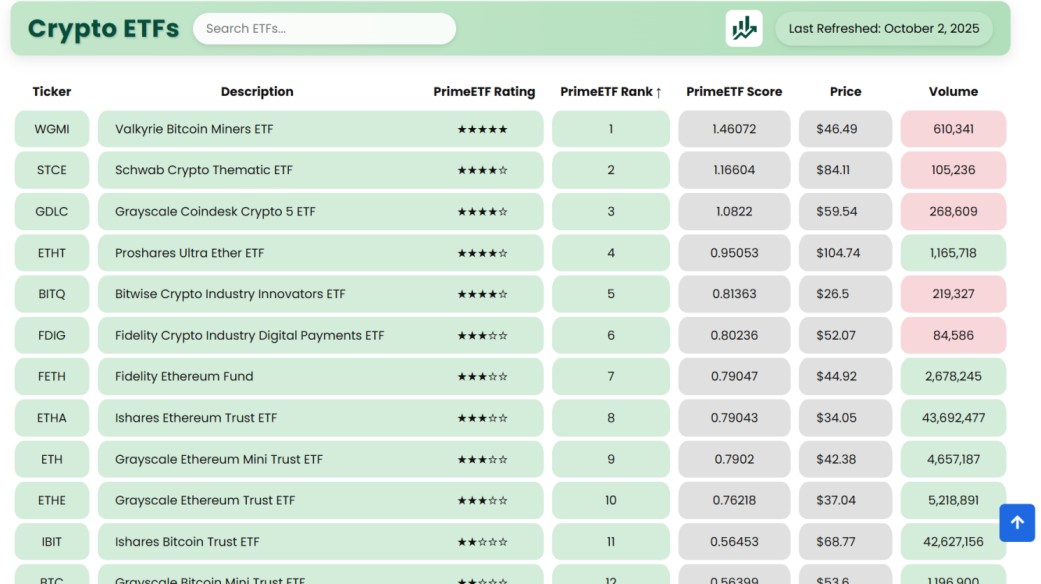

PrimeETF Expands: Launch of the Crypto ETF Universe

We’re not here to bet blindly on crypto.

We’re here to filter the noise, apply real rules, and guide capital where risk meets reward with intelligence.

- Let the charts speak.

- Let the algorithms lead.

- Let your money grow.

Currency ETFs retired. Crypto takes the lead.

We’re excited to announce a bold expansion to the PrimeETF platform. As of October 2, 2025, PrimeETF has officially launched a dedicated Crypto ETF Ranking Universe, reflecting the growing maturity, accessibility, and institutional adoption of digital assets.

In response to increasing demand and stronger regulatory clarity, we’ve made the strategic decision to:

Retire the Currency ETF section (which saw declining volume and relevance for most long-term investors)

and instead…

Introduce a high potential, algorithmically ranked list of Crypto ETFs, including Bitcoin, Ethereum, thematic blockchain ETFs, and diversified digital asset products.

Final Thoughts

While most portfolios struggled to navigate a choppy year, PrimeETF stayed disciplined — and it paid off.

The real achievement?

Not just the returns. But how they were earned — consistently, transparently, and without emotional trades. Markets are complex. But your system doesn’t have to be.

Thank you for being part of this journey.

Stay focused. Stay invested. Stay consistent.

See you in November.

Disclaimers

This is not financial advice. PrimeETF is a personal investing system based on real-money moves. Past performance is not indicative of future results. Always do your own due diligence before investing. PrimeETF is not a registered investment advisor. All decisions are your own responsibility. Crypto ETFs carry risk. GDLC is capped at 5% allocation. This newsletter is for informational purposes only and does not constitute investment advice.

Leave a Reply

You must be logged in to post a comment.