Dear PrimeETF Readers,

Most people believe rental income is only possible if you own real estate.

But what if your ETFs could generate monthly cash flow — just like rental properties — without tenants, repairs, or property taxes?

In this article, I’ll break down how the Covered Call Strategy can turn your ETF holdings into a consistent income stream — in a simple, step-by-step way.

I’ll even show you my real trades and income examples to prove how you can do it too.

Let’s dive in.

Quick Note:

I’m not here to tell you where to put your money—or to say real estate is bad.

I’m simply sharing what’s worked for me, with real money on the line.

If you need personalized advice, it’s best to speak with a certified financial planner.

But if you ever want a casual chat backed by a decade of hands-on investing experience (no fancy certifications here!), feel free to message me.

Just remember: copying someone else’s strategy without fully understanding it can seriously hurt your wallet. Always know what you’re getting into.

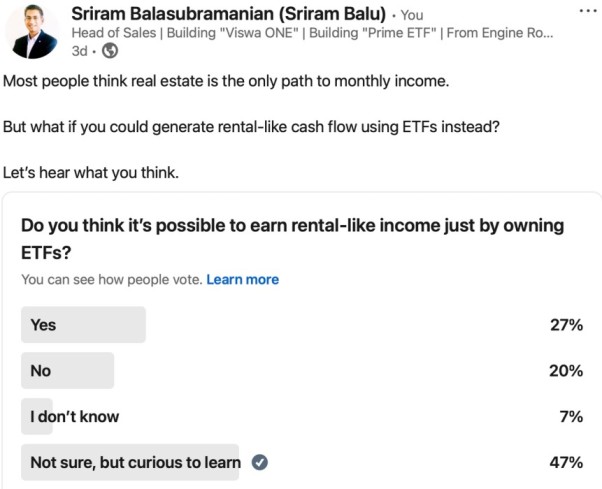

Source: Author’s LinkedIn poll

I recently ran a LinkedIn poll to get some feedback — and I’m truly grateful to the 15 people who voted! You made my day. Honestly, I was worried no one would respond.

As a small thank you, I’ll be sending each of you a personal DM with some insights you might find valuable.

In the poll, I asked whether people knew they could earn monthly income from their ETF holdings. Here’s what the responses revealed:

-

- 47% were curious but unaware that it’s possible.

- 20% believed it wasn’t possible, like real estate income — which is understandable!

- 7% weren’t sure.

Thanks again to everyone who participated — more to come soon!

Owning an ETF and earning monthly income – just like rental real estate?

It’s possible.

And it’s simpler than you think.

Recently, I sold a covered call on my IAU ETF holding and earned a ~2% monthly return – without selling my ETFs!

Here’s how it works:

-

-

- Imagine you own a house.

- You rent it out to someone.

- Every month, you collect rent.

- The house stays yours, but you make cash flow from it.

-

Now swap the house with an ETF.

-

-

- You own the ETF.

- You “rent out” the right for someone else to buy it from you at a slightly higher price.

- In return, they pay you an upfront premium (like advance rent).

- You still keep the ETF unless the price shoots up too high.

- This is called a covered call strategy.

-

Simple analogy:

Owning an ETF and selling a covered call is like putting a “For Sale at a Higher Price” board on your house, but you still live in it and collect rent every month!

If no one buys it, you simply take the board off and put a new one next month — and continue collecting rent!

In my case:

-

-

- I sold a call option on my IAU ETF.

- Earned around 2% in cash flow for the month.

- And I still own my IAU ETFs!

-

Key point:

-

-

- If the ETF price stays below the “for sale” price (strike price), you keep the ETF and the monthly income.

- If it rises past it, you may have to sell — but you already made a profit plus collected the rent!

-

You’ve seen the quick version above— now, let’s walk through it step-by-step.

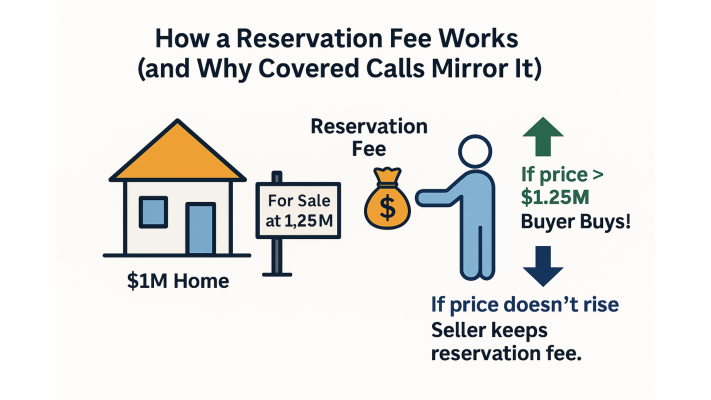

The Big Idea: Covered Calls

You believe property prices are going up, so you list it for $1.25 million — your Dream Price.

Someone loves the house but isn’t sure if prices will rise.

So, they pay you a small reservation fee to hold the option to buy later.

-

-

- If prices rise, they buy it at your dream price — you earn a premium plus a higher sale price.

- If prices don’t rise, they walk away — and you keep the reservation fee as pure income!

-

The Covered Call Strategy works the same way for your ETFs.

Step-by-Step: How Covered Calls Work on ETFs

Here’s how simple it is:

-

- Own an ETF

-

- Set a higher “Dream” sale price

-

- Perceive that the price may rise

-

- Buyer blocks the opportunity by paying you a premium

-

- If price rises above dream price → Buyer buys → You profit

-

- If price doesn’t rise → You keep the premium

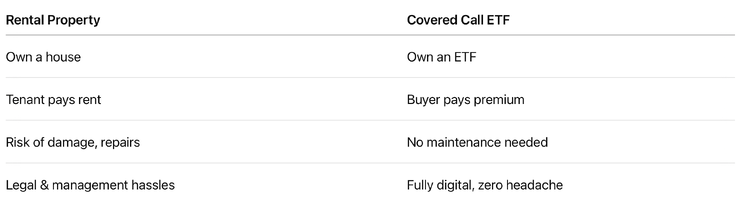

Covered Call vs Rental Property: A Beautiful Analogy

Owning ETFs and selling covered calls is almost identical to owning real estate rentals — except better.

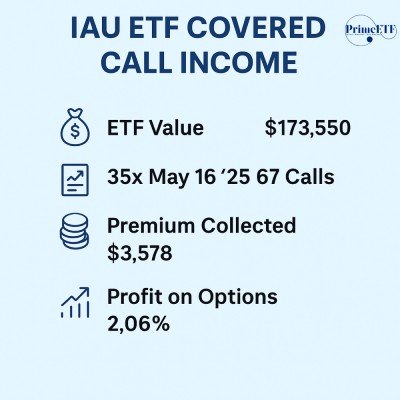

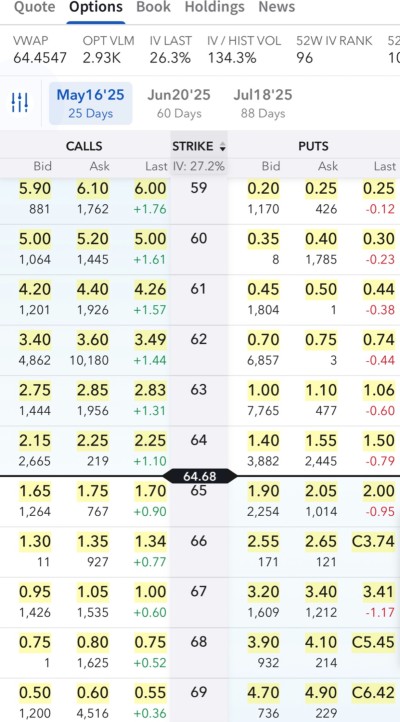

Real Life Example: My IAU ETF Covered Calls at Play

Now let’s see how I am applying this.

-

-

- Total Position Value: ~$173,550

- Covered Call Sold: 35 contracts, May 16, 2025, 67 Call

- Premium Collected: ~$3,578

- Premium Income as % of ETF Value: ~2.06%

-

Source: IAU ETF / Options chain

Why Covered Calls Are Powerful

-

-

- Monthly Cash Flow: You collect premium regularly like rent.

- Flexibility: You can set new “Dream Prices” every month.

- Downside Cushion: Premium collected reduces your effective cost basis.

- Semi-Passive Strategy: No repairs, no maintenance — just manage once a month.

-

The Wealthy Mindset Shift

Wealth is not about having a lot of money.

It’s about learning new skills, upskilling yourself, and unlocking new opportunities.

Money simply becomes a by-product of your evolved thinking.

Covered calls are just one of the hidden goldmines available for those who continuously learn.

Rental income isn’t tied only to real estate anymore.

Your investments can be your tenants.

Your skills can be your rental agency.

And your mind can be your biggest asset.

Your knowledge is your biggest property.

The more strategies you learn, the more “doors” you unlock for income.

Don’t limit your mindset.

Expand it.

Evolve it.

And you’ll find gold mines hidden in plain sight.

Thank you for taking the time to read this article. I look forward to sharing the next update in a week, covering the PrimeETF portfolio changes as we set sail into May 2025.

Building PrimeETF has been more than just a project — it has been a journey that shaped who I am today. It’s not the money that defines the success; it’s the experiences, the lessons, and the growth along the way.

None of this would have been possible without your support. Thank you for offering a sliver of your time — the most precious asset we all have.

Leave a Reply

You must be logged in to post a comment.