Dear PrimeETF Subscribers and Investors,

Why do I write these newsletters and share the PrimeETF Portfolio?

This is an important question; I want to be transparent and honest about it.

- First, I manage this portfolio with my own money. It’s not for fun or excitement—it’s serious about growing wealth over the long term

- Second, investing isn’t just about picking stocks. The key is sticking to a plan and managing your money wisely. To me, discipline and proper asset allocation matter more than anything else.

- Lastly, writing in public keeps me honest. I don’t just share my wins; I share my mistakes, too. This is a journey, and I want to show how someone with a full-time job can still build wealth steadily—without staring at charts all day or getting into derivatives trading.

PrimeETF is the tool I’m creating for busy professionals like me. With just 10 minutes a month, anyone can manage their investments confidently.

Whether starting with $10,000 or handling millions, the strategy stays the same:

- Be disciplined,

- Stay focused, and

- Play the long game.

This is why I write—I believe in this approach and want to help others make it work, too.

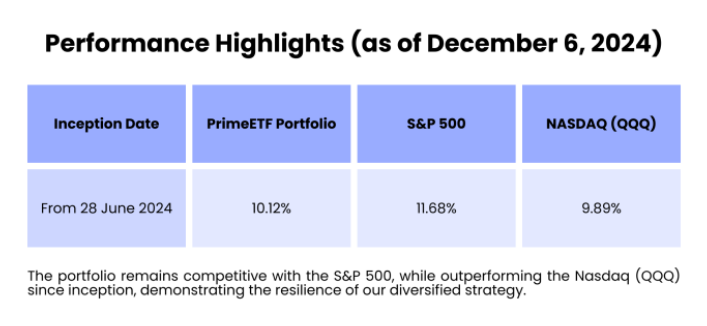

As we near the end of 2024, it’s time to reflect on the portfolio’s performance and provide insights into recent adjustments that have helped us maintain competitive returns while navigating market dynamics.

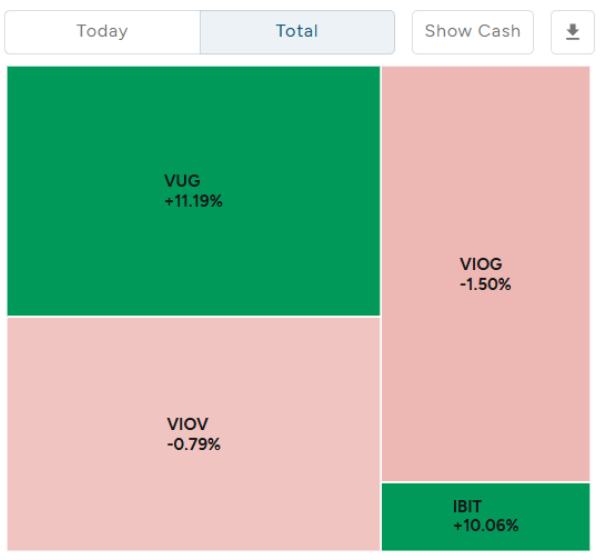

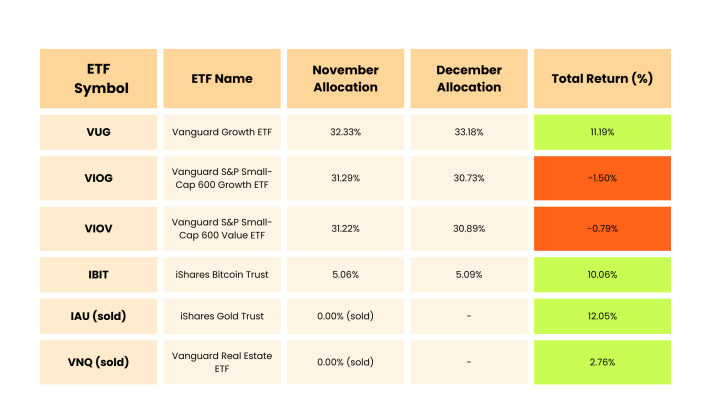

This month, we made strategic reallocations to align with upcoming market opportunities.

Source: PrimeETF December Portfolio 2024

S&P 500 vs PrimeETF Portfolio:

S&P 500 vs PrimeETF portfolio

NASDAQ 100 vs PrimeETF Portfolio:

NASDAQ 100 vs PrimeETF portfolio

TOTAL PORTFOLIO RETURNS:

PrimeETF – Total Portfolio Returns

ASSET ALLOCATION:

PrimeETF Portfolio Asset Allocation

Rebalancing Track Record / History:

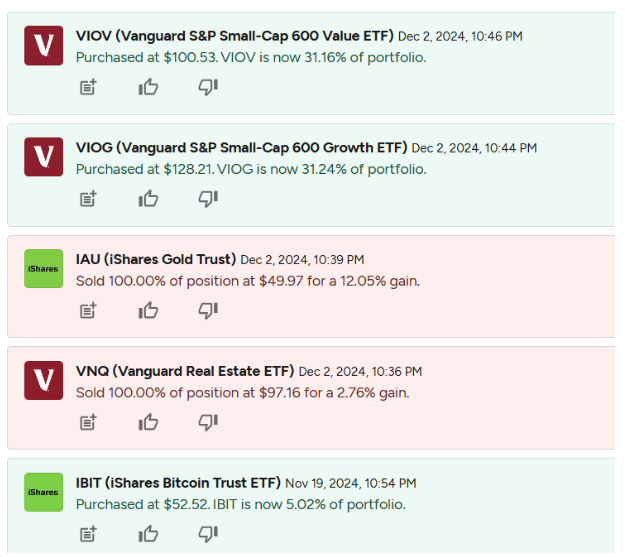

Source: PrimeETF’s Real-time Portfolio Tracker

Portfolio Rebalancing: November vs. December 2024

Source: Author’s Portfolio

Key Strategic Adjustments:

Key Trades in December:

Sold Defensive Assets:

- iShares Gold Trust (IAU): Sold for a 12.05% gain.

- Vanguard Real Estate ETF (VNQ): Sold for a 2.76% gain.

Increased Growth Exposure:

- Reallocated to VUG (Vanguard Growth ETF) for higher growth potential.

- Maintained a calculated position in IBIT (iShares Bitcoin Trust) to leverage cryptocurrency’s bullish trend.

Small-Cap Exposure Adjustment:

- Focused on VIOG and VIOV for potential upside in the small-cap sector despite short-term underperformance.

Added Crypto Exposure – Read this post here:

𝗕𝗶𝘁𝗰𝗼𝗶𝗻: 𝗔 𝟰𝟳% 𝗥𝗲𝘁𝘂𝗿𝗻 𝗶𝗻 𝟭𝟳 𝗗𝗮𝘆𝘀—𝗪𝗵𝗮𝘁’𝘀 𝘁𝗵𝗲 𝗟𝗲𝘀𝘀𝗼𝗻 𝗛𝗲𝗿𝗲?

Objective:

PrimeETF is designed to deliver S&P 500-like returns with lower drawdowns, balancing growth with stability for busy professionals. As demonstrated since inception, the portfolio has tracked the S&P 500 closely, outperforming the Nasdaq while minimizing risk exposure.

What’s Next?

As we move into 2025, the focus remains on:

- Growth-Oriented Rebalancing: Staying ahead of market trends through algorithm-driven insights.

- Risk Management: Ensuring steady returns while protecting against market volatility.

- Investor Simplicity: Making it easy for you to manage wealth in under 10 minutes a month.

Thank you for trusting PrimeETF on your investing journey.

Here’s to an even more prosperous 2025!

Warm regards,

Sriram Balu

Founder, PrimeETF

“Simplifying Investing for Busy Professionals“

Disclosure and Disclaimer:

This portfolio update is for informational purposes only. Past performance is not indicative of future results. Investments involve risks, including the potential loss of principal. This is not financial advice; please be sure to consult a professional for personalized investment guidance.

Leave a Reply

You must be logged in to post a comment.