Happy Diwali & Halloween investors!

Let’s jump onto the PrimeETF portfolio performance.

Performance Overview:

For October, the PrimeETF Portfolio performed solidly, showing resilience despite market fluctuations due to the ongoing U.S. election season.

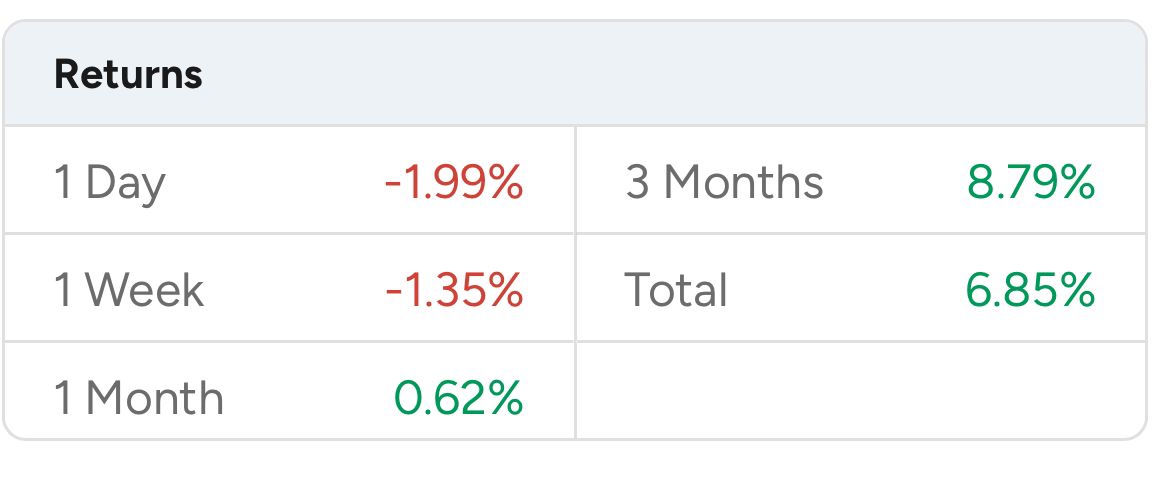

Here’s how each time period fared:

- 1-Day: -1.99%

- 1-Week: -1.35%

- 1-Month: +0.62%

- 3-Months: +8.79%

- Total (since inception): +6.85%

Source: PrimeETF October 2024 Portfolio

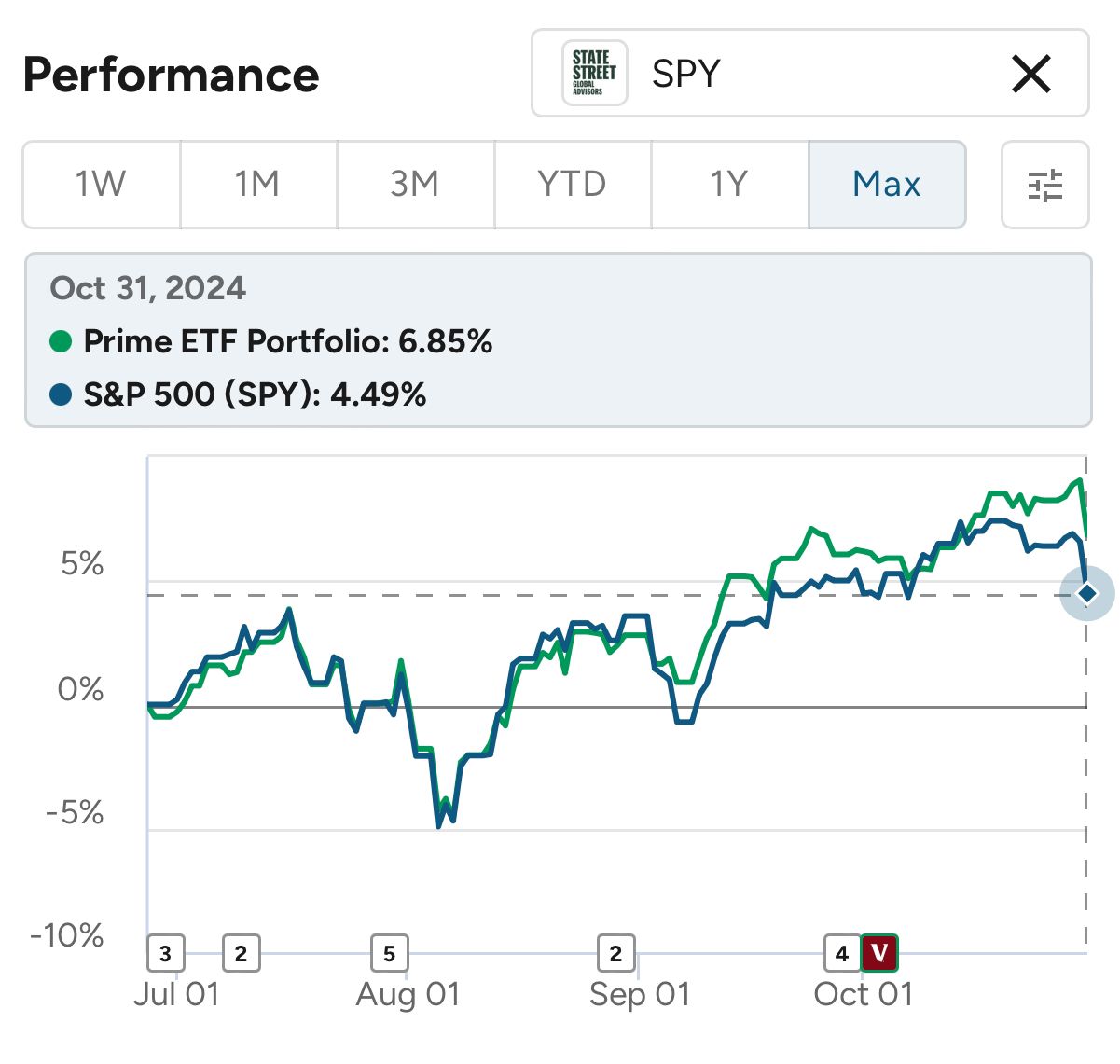

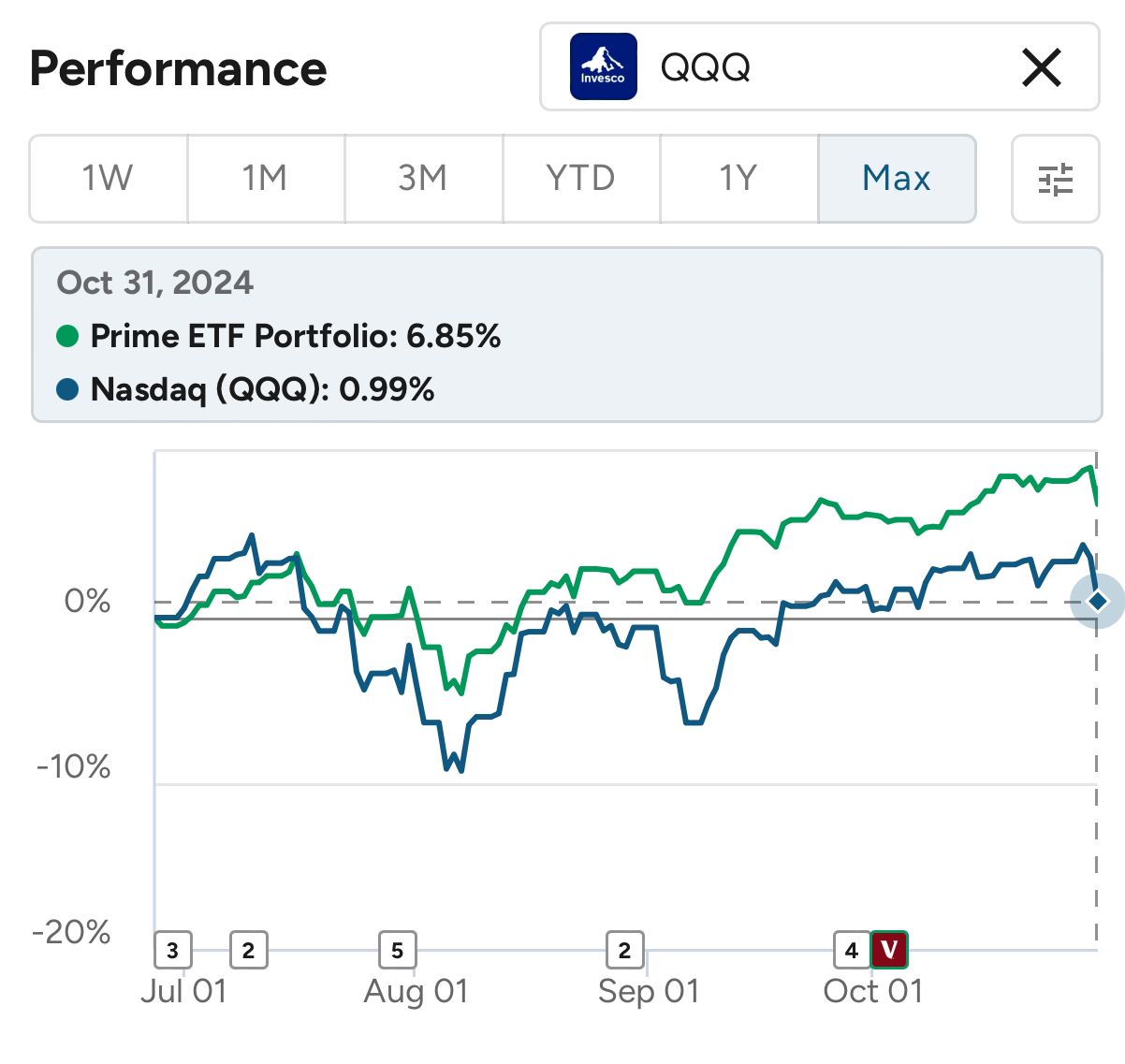

Monthly Performance: Comparison Since Inception

Since its inception, the Prime ETF Portfolio has outpaced the S&P 500, highlighting its ability to deliver steady growth with lower drawdowns.

- Prime ETF Portfolio Cumulative Performance: +6.85%

- S&P 500 Cumulative Performance: +4.49%

Source: PrimeETF October 2024 Portfolio

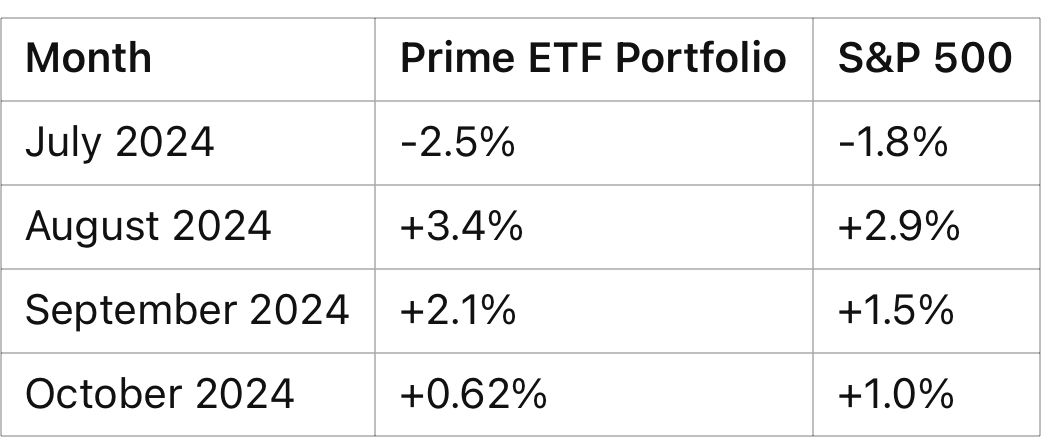

Performance Analysis:

- July 2024: The portfolio experienced a minor dip, similar to the S&P 500, but managed to limit losses better than the broader market.

- August 2024: A strong recovery month, driven by gains in growth stocks and gold, resulting in a 3.4% gain.

- September 2024: Continued growth as both the portfolio and the S&P 500 posted positive returns, with the portfolio outperforming again.

- October 2024: Despite election-related volatility, the portfolio achieved a modest gain of 0.62%, maintaining its edge over the S&P 500.

The Prime ETF Portfolio’s diversified approach, blending growth stocks, gold, and real estate, has provided more stability than the S&P 500 over this period.

Source: PrimeETF October 2024 Portfolio

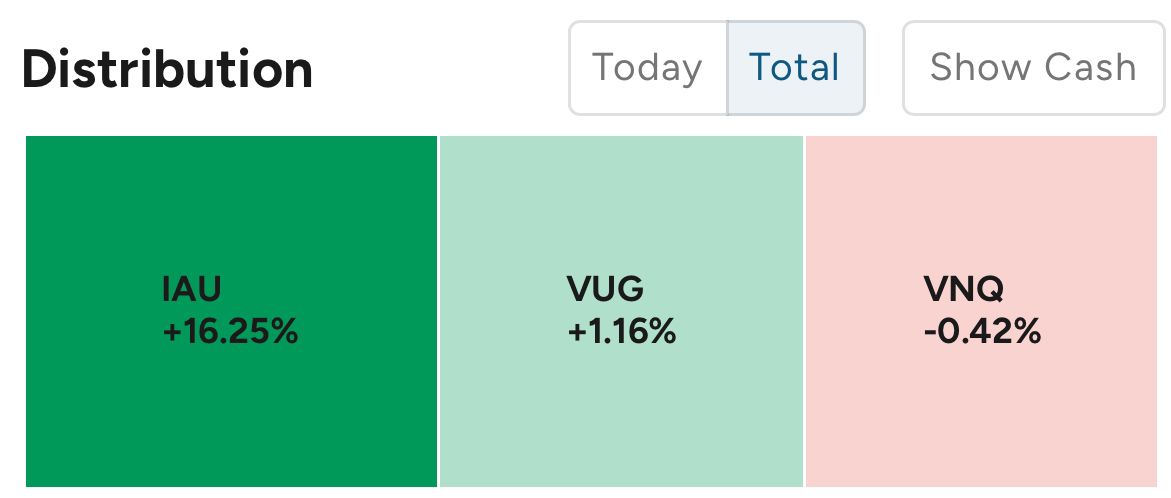

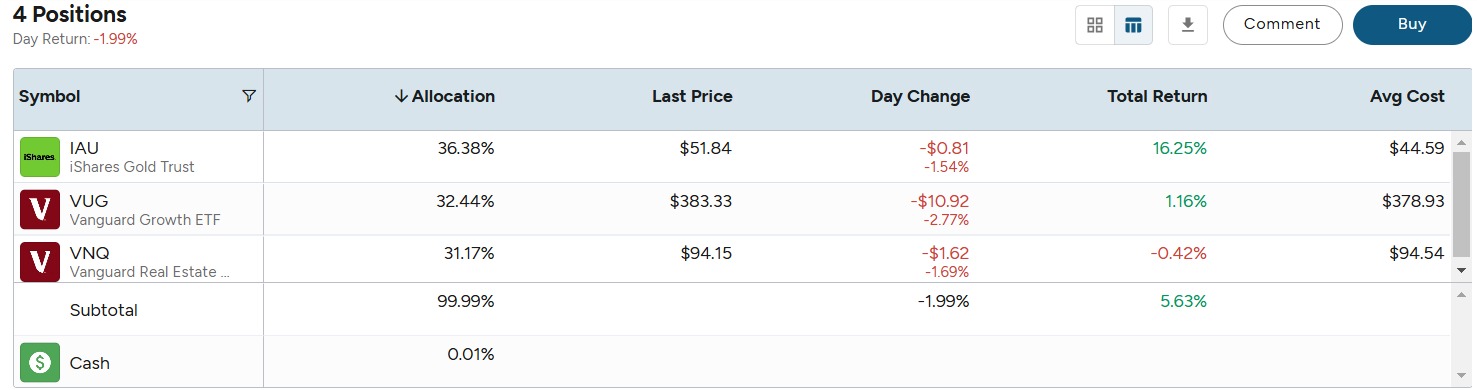

Asset Allocation:

The portfolio currently holds three key assets:

- IAU (Gold): +16.25%

- VUG (Growth Stocks): +1.16%

- VNQ (Real Estate): -0.42%

Gold (IAU) has been a strong performer, acting as a buffer against market volatility, while growth stocks (VUG) and real estate (VNQ) offer growth potential for the long term.

Source: PrimeETF October 2024 Portfolio

Market Volatility and News:

This month, market volatility was largely influenced by the upcoming U.S. elections, leading to some fluctuations in stock prices as investors reacted cautiously. However, our diversified portfolio remains well-positioned to handle such market fluctuations.

Next Month Rebalance:

No changes are planned for the upcoming rebalance. IAU, VUG, and VNQ continue to be the top-performing assets and will remain in the portfolio.

Disclosure and Disclaimer:

This portfolio update is for informational purposes only. Past performance is not indicative of future results. Investments involve risks, including the potential loss of principal. This is not financial advice; please consult a professional for personalized investment guidance.

Keep watching for more updates!

Best,

The PrimeETF Team

Leave a Reply

You must be logged in to post a comment.