Dear Investors & Readers of PrimeETF,

Thank you for being here.

While many portfolios continue to struggle in this choppy and uncertain market, PrimeETF stayed disciplined — and it paid off.

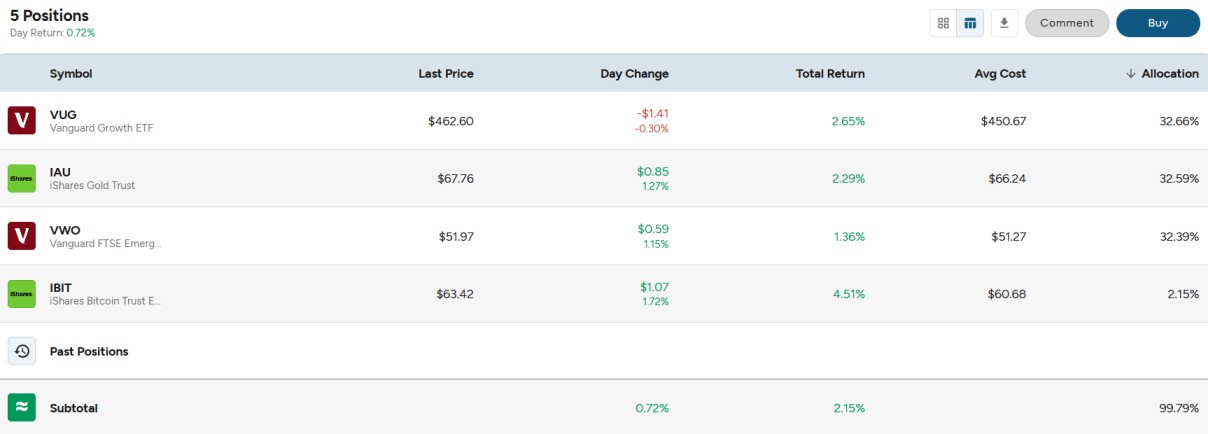

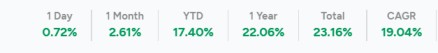

As of 7th September 2025, the PrimeETF Portfolio has returned +23.16% since inception, outperforming the S&P 500 (SPY: +18.93%).

What’s more compelling than the returns is how they were achieved:

Through systematic ETF selection

Through monthly rebalancing

And through complete transparency with a real-money portfolio

“No forecasts. No fancy software. Just rules, routine, and real investing”

Why PrimeETF Outperformed

It’s not magic. It’s math. And the goal is NOT to outperform, but to minimise the drawdowns. Outperformance is a consequence.

Here’s what drove the edge:

- Data-Driven Selections – ETFs were selected based on a rule-based, systematic, and algorithmic model, favouring strength over sentiment.

- No Overlap, Maximum Exposure – Diversified by theme, geography, and factor, avoiding duplication.

- Monthly Rebalancing – Winners stayed. Laggards rotated out, emotion-free.

- Skin in the Game – This is a real-money, fully transparent portfolio. No simulations. No theories. No backtests!

This approach reduces drawdowns and increases conviction, especially in volatile markets like this.

Why PrimeETF Works for People with Full-Time Jobs

Most people don’t have the time to analyse the market, backtest strategies, or time their trades.

And I realised that my investment capital is directly proportional to the confidence in the system or the process.

“Your investment capital is directly tied to the level of confidence you have in the system”

you’re unsure, you’ll invest a small amount.

If you’re clear and fully understand the system/process behind the investments, you can invest meaningfully with a large corpus. If your net worth is $1 million, and investing $10,000 in a stock or an ETF doesn’t move a needle. I want to build a system that allows me to confidently invest my net worth with conviction, control, and clarity.

That’s the entire goal of PrimeETF — to make investing so simple and so transparent that busy professionals like us can stay focused on WORK (where your true wealth is built) and still grow long-term wealth in the background.

Important Reminder

I’m not a financial advisor, and PrimeETF is not investment advice. But what I offer is real. I have 100% skin in the game. These portfolios are my own — built with my money, tested monthly, and followed in real time. No backtested illusions. No theoretical outperformance. Just transparent, rules-based investing you can understand and implement — even with limited time.

Market Highlights – September 2025

- Geopolitical Stress: Ongoing conflicts, sanctions, and tariff disputes are prompting capital flows into energy and defence sectors, driving gold higher amid broader risk-off sentiment.

- Bitcoin ETF (IBIT) inclusion added uncorrelated alpha. The big firms are exploring more crypto ETFs, and it is essential to consider Crypto as an asset class, although it increases the overall volatility of the portfolio.

This divergence proved again that static portfolios, such as the traditional 60/40 or buy-and-forget portfolio, lag behind the PrimeETF.

August ended strongly as inflation fears cooled, and investor sentiment rebounded globally.

Trends Observed:

- Bitcoin surged alongside tech.

- Gold remained resilient amid global jitters.

- Emerging markets strengthened (India, China).

- Developed markets weakened, and VEA was removed from holdings.

“Adaptability matters. Rules matter. Timing matters.”

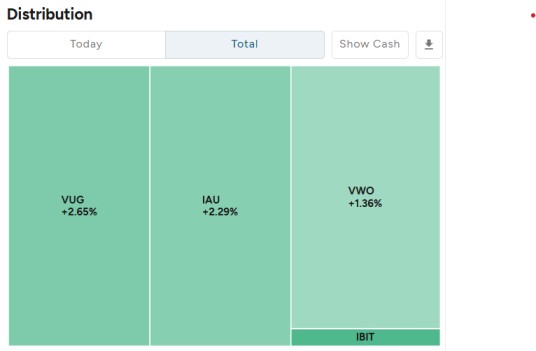

Portfolio Changes & Rebalancing: September 2025

We exited:

- VEA (Vanguard Developed Markets ETF) with a +13.86% gain

We rotated into:

- VWO and IBIT to add emerging market upside and digital asset exposure.

We sold all the holdings and booked profits. We rebalanced the portfolio into 4 ETFs as per below.

Source: PrimeETF real money portfolio

Why I Built PrimeETF

I didn’t start PrimeETF as a business.

I started it because, like many of you, I needed a better way to invest while working full-time.

I wanted:

- A system I could trust

- Without constant monitoring

- Without falling for social media noise

- And without giving control to someone else

When your system is strong, your conviction is strong.

And when conviction is high, you invest more confidently, more meaningfully.

That’s the foundation of PrimeETF.

What You Get Each Month

- Updated ETF picks based on trends and ETF Ranking.

- Rebalance alerts with allocation percentages

- Performance tracked vs SPY and 60/40 benchmark

- Portfolio composition and rationale

- Fully transparent, rules-based execution

And all of it — manageable in under 10 minutes a month.

You stay focused on your work, career, or business — while the system quietly compounds in the background.

The Vision Ahead

PrimeETF will continue to evolve.

The next phase is to:

- Launch Prime7 Portfolios

- Launch a listed PrimeETF fund (or)

- Build a tech platform where users can invest seamlessly.

But until then, the Prime7 Portfolios are my commitment to helping professionals like you take control of investing with structure and simplicity.

This is how wealth is built — quietly, consistently, and confidently.

Thank you for reading, supporting, and being part of the journey.

Stay disciplined. Stay invested.

Sriram Balu

Disclaimer:

This is not financial advice. Please consult your financial advisor before making investment decisions. All opinions expressed are personal and not for any organisation. Investing in PrimeETF is at your own risk. All information and data are for educational purpose only!

Leave a Reply

You must be logged in to post a comment.