A heartfelt thank you to every investor, reader, and well-wisher. PrimeETF just turned one—and there’s no better way to celebrate than by doing what matters most: showing results.

This special anniversary edition took a little longer than usual to write—not because I ran out of words, but because I wanted to back every word with real data and real calculations. There could be some errors or mistakes and if you find any, do comment and I shall learn from you!

When I first started tracking PrimeETF publicly, I had one clear goal in mind:

“Match the returns of the S&P 500—but with significantly lower drawdowns”

In other words, if the S&P 500 fell 30%, PrimeETF should ideally fall just 10% to 20%. The mission was simple: protect on the downside, participate on the upside.

After 12 months of running this real-money portfolio—sharing trades transparently and publishing monthly rebalance updates—I’m thrilled to report this:

PrimeETF has not only met its risk goals but has also outperformed the S&P 500 and even the Nasdaq 100.

That’s right. We aimed for “less pain” during corrections—and ended up delivering more gain.

In this edition, I’ve done something special.

I’ve broken down what would’ve happened if you had invested $100K in various popular “lazy portfolios” versus putting the same in PrimeETF.

-

- Performance comparisons

- Performance comparisons

- Real numbers,

- Real trades

- No backtests—just forward results tracked in public

Let’s dive in.

Let the numbers speak.

And let this be proof that even busy professionals can win with a smarter, rules-based approach to investing.

Let’s go.

-

- What would happen if you invested $100,000 in a passive ETF portfolio one year ago?

- Would you choose the classic 60/40?

- The global market index?

- Or a tactical strategy like PrimeETF that rebalances monthly with real capital?

In this article, I compare the performance of 12 of the most popular lazy portfolios against my own real-money, monthly-rebalanced PrimeETF portfolio. The results are clear, and the lessons are powerful.

Methodology

-

- Initial Investment: $100,000 in June 2024 (just an example)

- Portfolio Duration: 12 months ending June 2025

- ETF Selection: Vanguard and equivalent ETFs

- Return Data: 1-Year Performance from google finance or yahoo finance.

- PrimeETF: Calculated from my actual trades with weighted monthly exposure

- Dividends: Excluded

- Transaction Costs: Excluded

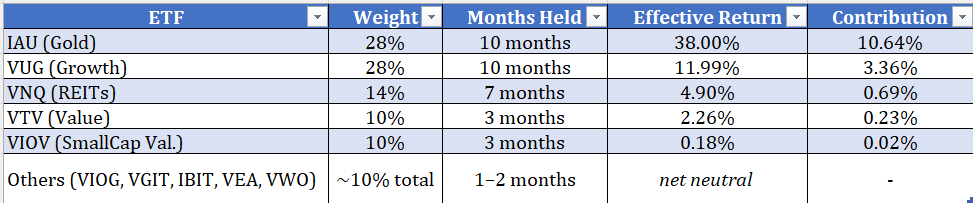

PrimeETF Portfolio Breakdown

“Total 1-Year Return: 18.28% Final Portfolio Value: $118,280”

Source: Author’s compilation

Lazy Portfolios: Holdings and Step-by-Step Performance

Here’s a breakdown of each lazy portfolio, its holdings, and its weighted return based on 52-week ETF performance:

1. Permanent Portfolio

-

-

-

- 25% VUG (Growth): +14.39%

- 25% VGIT (Bonds): +1.75%

- 25% VCLT (Long Bonds): -2.48%

- 25% IAU (Gold): +45.60%

- Total Return: 14.82%

- Final Value: $114,820

-

-

2. Golden Butterfly Portfolio

-

-

-

- 20% VUG (Growth): +14.39%

- 20% VIOV (SmallCap Val.): +0.74%

- 20% VGIT (Bonds): +1.75%

- 20% VCLT (Long Bonds): -2.48%

- 20% IAU (Gold): +45.60%

- Total Return: 12.00%

- Final Value: $112,000

-

-

3. Bogleheads Portfolio

-

-

-

- 50% VUG (Growth): +14.39%

- 30% VEA (Developed Markets): +12.24%

- 20% VGIT (Bonds): +1.75%

- Total Return: 11.22%

- Final Value: $111,220

-

-

4. 60/40 Portfolio

-

-

-

- 60% VUG (Growth): +14.39%

- 40% VGIT (Bonds): +1.75%

- Total Return: 9.33%

- Final Value: $109,330

-

-

5. Core Four Portfolio

-

-

-

- 40% VUG (Growth): +14.39%

- 20% VEA (Developed Markets): +12.24%

- 10% VNQ (REITs): +8.40%

- 30% VGIT (Bonds): +1.75%

- Total Return: 9.28%

- Final Value: $109,280

-

-

6. Three Fund Portfolio

-

-

-

- 33.3% VUG (Growth): +14.39%

- 33.3% VEA (Developed Markets): +12.24%

- 33.3% VGIT (Bonds): +1.75%

- Total Return: 9.07%

- Final Value: $109,070

-

-

7. Merriman Portfolio

-

-

-

- 6% each: VTV, VUG, VIOV, VIOG, VEA, VWO

- 10% VNQ, 40% VGIT

- Weighted Return: 8.97%

- Final Value: $108,970

-

-

8. 100% Equity Aggressive

-

-

-

- 40% VTV (Value): +9.05%

- 20% VIOV (SmallCap Val.): +0.74%

- 20% VEA (Developed Markets): +12.24%

- 20% VWO (Emerging Markets): +12.43%

- Total Return: 8.42%

- Final Value: $108,420

-

-

9. Larry Swedroe Portfolio

-

-

-

- 30% VTV (Value): +9.05%

- 30% VIOV (SmallCap Val.): +0.74%

- 15% VNQ (REITs): +8.40%

- 25% VGIT (Bonds): +1.75%

- Total Return: 7.60%

- Final Value: $107,600

-

-

10. Global Market Portfolio

-

-

-

- 50% VEA (Developed Markets): +12.24%

- 50% BNDX (Int’l Bonds): +1.73%

- Total Return: 6.99%

- Final Value: $106,990

-

-

11. All Weather Portfolio

-

-

-

- 30% VUG (Growth): +14.39%

- 40% VCLT (Long Bonds): -2.48%

- 15% VGIT (Bonds): +1.75%

- 7.5% IAU (Gold): +45.60%

- 7.5% PDBC (Commodities): -5.73%

- Total Return: 6.58%

- Final Value: $106,580

-

-

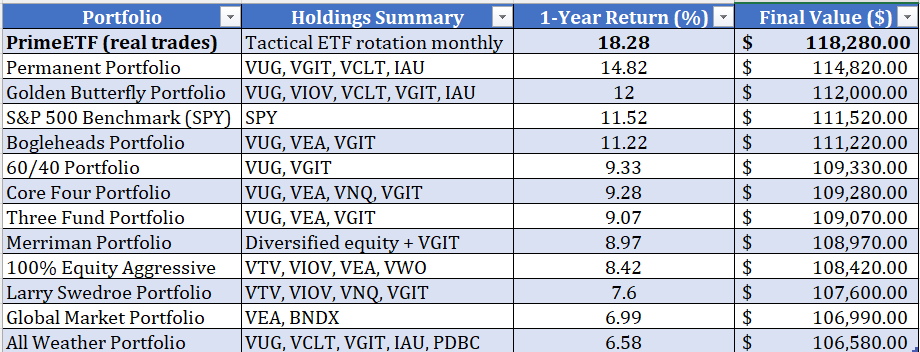

Final Performance Table (All Portfolios):

The chart below illustrates how each strategy performed over the year. PrimeETF leads the pack, followed closely by the Permanent and Golden Butterfly portfolios. The S&P 500 came in fourth, while traditional portfolios like the 60/40 lagged. This do not guarantee any future returns though.

Source: Author’s Compilation

Insights

1. PrimeETF Outperformed All

The PrimeETF delivered the highest return at 18.28%, despite using only ETFs and requiring minimal monthly attention.

2. Gold Was the X-Factor

A 28% to 33% weight in IAU (gold) captured much of the year’s upside, with gold up over 45% for the year.

3. Lazy Portfolios Still Hold Up

Permanent and Golden Butterfly portfolios held their ground well. Simplicity still works.

4. Tactical Beats Static in Dynamic Markets

While static models performed decently, PrimeETF’s real advantage came from monthly adjustments based on trend data.

PrimeETF Works

-

- It’s Real: Real capital, real trades, real risk.

- It’s Simple: Just ETFs. No stock picking or day trading.

- It’s Designed for Busy People: 10 minutes a month is all it takes.

Source: Author’s Real Time Performance Tracking

PrimeETF exists for professionals who don’t want to stare at charts all day but still want to beat average returns.

My Take:

The evidence is in. While lazy portfolios offer consistent returns, adding smart, simple rebalancing can take you further. PrimeETF proved this with real capital and real results.

If you’re a working professional, executive, or entrepreneur looking to grow your wealth passively yet smartly, PrimeETF may just be the portfolio you’ve been searching for. Reach out and I shall guide you to get started with the PrimeETF portfolios.

Thank You for Reading — Here’s What’s Next

If you’ve made it this far, thank you sincerely for your time and attention. I know how valuable it is, and I don’t take it lightly.

Starting 1st July 2025, I’ll be:

-

- Building and publishing live model portfolios with full transparency

- Tracking performance publicly so you can follow what works (and what doesn’t)

- Empowering at least 50 investors to take control of their money with clarity and confidence

This initiative is part of my continued effort to simplify investing for busy professionals. Whether you’re just starting out or managing significant capital, the goal is the same: help you stay consistent, informed, and ahead.

Important Disclaimer:

-

- This article is meant for educational purposes only

- Past performance does not guarantee future results

- PrimeETF is not a licensed financial advisor, and any investments could result in full loss of capital.

- Always consult a qualified financial advisor before making any investment decisions.

- Taxation differs across countries – all portfolio returns shared are based on Singapore tax laws, where I currently reside.

If this resonates with you or you’re curious about how this unfolds, I invite you to follow along.

Our mission is simple: To empower busy professionals with full-time careers to invest smarter, with transparency, simplicity, and clear strategies that cut through the noise.

PrimeETF – Invest Smarter. Not Harder.

I don’t just believe in systematic investing — I live it.

PrimeETF is my real-money portfolio, built while working full-time.

- Not a passion project.

- Not theory.

- Just a practical solution for busy professionals.

It employs a simple, rule-based algorithm rooted in mathematics and statistics, designed to help people like us manage our finances without needing to monitor the markets constantly.

The mission? To demonstrate that you don’t need a finance degree or free time to grow your wealth. Just a system that works. And the discipline to follow it. However, you MAY need a financial advisor to map your investments towards your goals.

Leave a Reply

You must be logged in to post a comment.